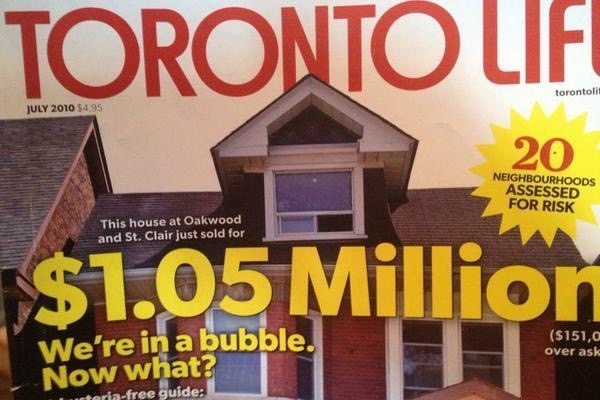

Ever notice that every time you turn on the TV or read the paper there is some tragic warning about what is about to happen to the Toronto Real Estate Market? Don’t believe me? Here’s a sampling of national and local headlines from the past FIVE years:

“Housing bubble a danger: expert” – CBC News, 11/18/2010

“Canada’s Household Debt Soars To New High As Economy Leaves Little Room To Maneuver” – Huffington Post, 9/14/2011

“Canada’s ‘housing bubble’ deemed close to bursting” – CBC News, 6/29/2011

“Time to panic: Canada looks just like the U.S. did before the housing crash” – Macleans, 2/28/2012

“Be very afraid of the Canadian housing bubble” – CBC News, 4/16/2012

“Prediction: The Canadian housing market will crash” – Canadian Business Magazine, 8/12/ 2012

“Canada’s housing hangover: Real estate boom, meet dot-com crash” – Globe and Mail, 1/2/2013

“Canadian Housing Boom Over, Economists Say” – Financial Post, 3/11/2013

“Canada’s housing market among most ‘bubbly’ in world: Economist” – Yahoo Finance, 9/4/2013

“Housing boom expected to cool, crash fears linger: Poll” – BNN, 2/25, 2014

“IMF warns over Canada’s ‘overheated housing market” – Global News, 3/10/2015

“ Toronto, Vancouver home prices could plunge 30%” – Financial Post, 7/28/2015

Whoa nelly. You’d think that Canada’s housing market was the champagne industry — there’s so much talk of bubbles. For the past five years (check out the dates on these new stories) it’s been ‘Toronto Condo Bubble’ this and ‘Toronto Real Estate Market Crash’ that. Yet the market keeps, well, bubbling along. Media and some economists have been dutifully predicting a crash in house prices every year since at least since 2010. Yet every year, the market continues to go up. From the Toronto Real Estate Board’s last posted July 2015 Home Price Index data: detached homes in Toronto are up almost 9%, semi-detached almost 8% and condos, almost 4%.

Of course that must mean that if the crash and bubble predictions didn’t come true last year and the year before that it simply HAS to happen this year! And the fact that prices are still up and rising must mean that they are overvalued, right?? The CMHC – Canada’s Federal housing agency – placed an estimate that the Canadian market is about 3 to 4 per cent overvalued earlier this year (as they have also done in 2012, 2013 and 2014) – issuing the statement: “The rise in house prices has not been matched by growth in personal disposable income, giving rise to a modest risk of overvaluation.” The media’s buzz words after the announcement? “OVERVALUED!” “NEAR HISTORIC PEAKS” and “HIGH RISK.”

They’re good, those media folk. I mean, they really know how to get you watching and reading and talking and completely worked up about issues that are far less significant than you are made to think. They feed on your fear. Ever notice that during the daily CTV National News broadcast the top stories are all about murders and political turmoil and financial disasters…but they reserve the last 3 minute-block at the end for a little something happy? Back in the day Dateline NBC did an epic job of fear mongering: “Unseen danger in bagged salads!!!” and “Could the crib in your baby’s bedroom turn deadly? Recall alert!” There’s a name for all this. It’s called “Sensationalism.” Because of what I read in the news I simply must hike Mount Kilimanjaro before the “snow all melts”, must visit Vienna before “it sinks” and must bury all my money under a mattress to prevent survival when “the stock market crashes” and “the housing market bursts.”

Even if the Toronto Real Estate Market is what they say it is at the moment (3-4% overvalued) is it really all that irrational that someone might want to still buy a house or a condo this Fall? Absolutely not. You see, you and I are only doing what makes sense: borrowing money when money is cheap, turning to what is arguably a more conservative investment than stocks at this time, buying before affordability in our globally-expanding city just becomes impossible, and accepting that we actually do live in one of the most stable cities to invest in the world. You need a home, right? So stop waiting for the news to tell you that now is the perfect time. Truth: the media never will and those that wait too long will get priced out of the market.

Listen up. I’m not an expert on the future of our economy nor the predictor for a housing bubble or financial crash. I am however a full time Toronto Realtor working in the Toronto Real Estate Market. I work with people who want to find homes to live in and want to investment their money safely. When we in the real estate industry talk about Toronto’s housing market, we talk about what we physically and tangibly see. We see FACTS. And the facts right now and last year and the year before and the year before that are all based on sales numbers and prices and percentage of appreciation year over year…which continue to go up. Which, if you think about it, shouldn’t be oh so shocking when you consider the globalization of Toronto. Meanwhile the media, well (and I can say this because I used to be in it), they focus on stories that you will read and watch. And trust me: a story about stable markets is simply not good news, and not anything people will want to read, so not anything people will read so something has to get talked about. The media takes the reports from the banks, mortgage companies and government agencies who tend to focus on risks (overvaluation, overbuilding and over leveraging), and more often than not because they have a word count or an angle…make a story out of one point. And the fact is we read it — because everybody cares about real estate a whole lot because we all either own a home already or want to own one one day soon.

So, in summary, stop being Chicken Little. Unless of course you really do want to rent forever.

Have questions or concerns? Contact me to discuss them any time.

***Featured image is, yes, my son (circa 2012) I thought his expression perfectly captured what the media is doing to the public’s on the matter. Right? 🙂